|

|

| Source: Asahi N.P., 9/12/99 |

| Remarks: |

|

|

| Source: Asahi N.P., 9/12/99 |

| Remarks: |

Stock Prices (1997 - 1999/200): International Comparison

|

|

|

|

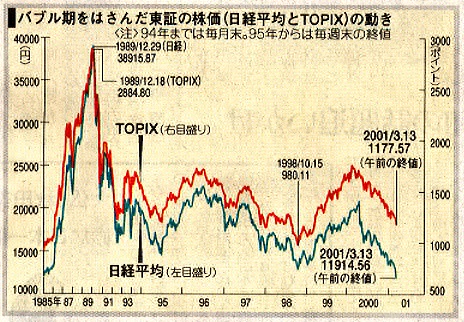

| Source: Asahi N.P., 12/29/99 | Source: Asahi N.P., 4/18/00 | Source: Asahi N.P., 3/13/01 |

| Remarks: See <<8/31/98>> for the reasons for the world-wide fall in the stock prices around the summer of 1998. | Remarks: |

Japanese Discount Rate, 1965 - 1999

|

|

| Source: Asahi N.P., 7/17/99 |

Japanese Business Cycle, 1980 - 2000

|

|

| Source: Asahi N.P., 6/20/00 |

Credit Expansion and Credit Crunch in Japan:

| 1987-1990/91 |

Banks lend firms aggresively.

[Low interest rate [See Plots 5: Outstanding of Loans of All Banks in Jpn (全国銀行貸出残高) and its growth rate.] |

| 1990/91-present |

[See Plots 5: Outstanding of Loans of All Banks in Jpn (全国銀行貸出残高) and its growth rate.] Banks become highly reluctant to lend.

[Prcies of assets (stock, land and real estate) that firms had purchased and relied on as collateral for further borrowing from banks fell sharply. |

Highlights of yen_dollar exchange rate and Jpn economy:

A

B

1972q2

Adjustment period: December 1971 to February 1973.

1973q1

The flexible exchange rate system started: The major currencies began to float.

1973q4

First Oil Crisis: $2.60 to $11.7 a barrel (more than fourfold increase) in a single year

1978q4

Second Oil Crisis: $12.7 to $34 a barrel (a rise by 300%) over a period of 34 months (from 1979 to October 1981)

1985q3

Plaza Agreement: Revaluation of the yen (depreciation of the dollar). [See Plots 1: Yen Exchange Rate and Jpns GDP growth rate.]

1985q4

High-yen recession: from 1986 to 1987

1988q1

High-yen boom (Heisei Boom): from 1987/88 to 1989. [See Plots 2: Jpns Stock Price and GDP growth rate; Plots 3: Oil Price and Jpns Land Price.]

1991q2

Heisei Recession: from 1990 to present. [See Plots 2: Jpns Stock Price and GDP growth rate; Plots 3: Oil Price and Jpns Land Price.]

1997q3

Unstable Asian currencies [See Plots 4: Recent Asian Stock Price and Exchange Rate Behavior.]